Notes from the 3rd Insurance Data Science event

Finally, the Insurance Data Science conference was back last week. After last year’s cancellation due to Covid-19 over 250 delegates from around the world came together on-line for the third instalment of the conference.

The event kicked-off, or should we say lifted off, with a keynote by Thomas Wiecki, CEO of PyMC Labs, on Wednesday. Thomas explained how probabilistic programming can be used to assess risk and make decision in the context of insuring rocket launches.

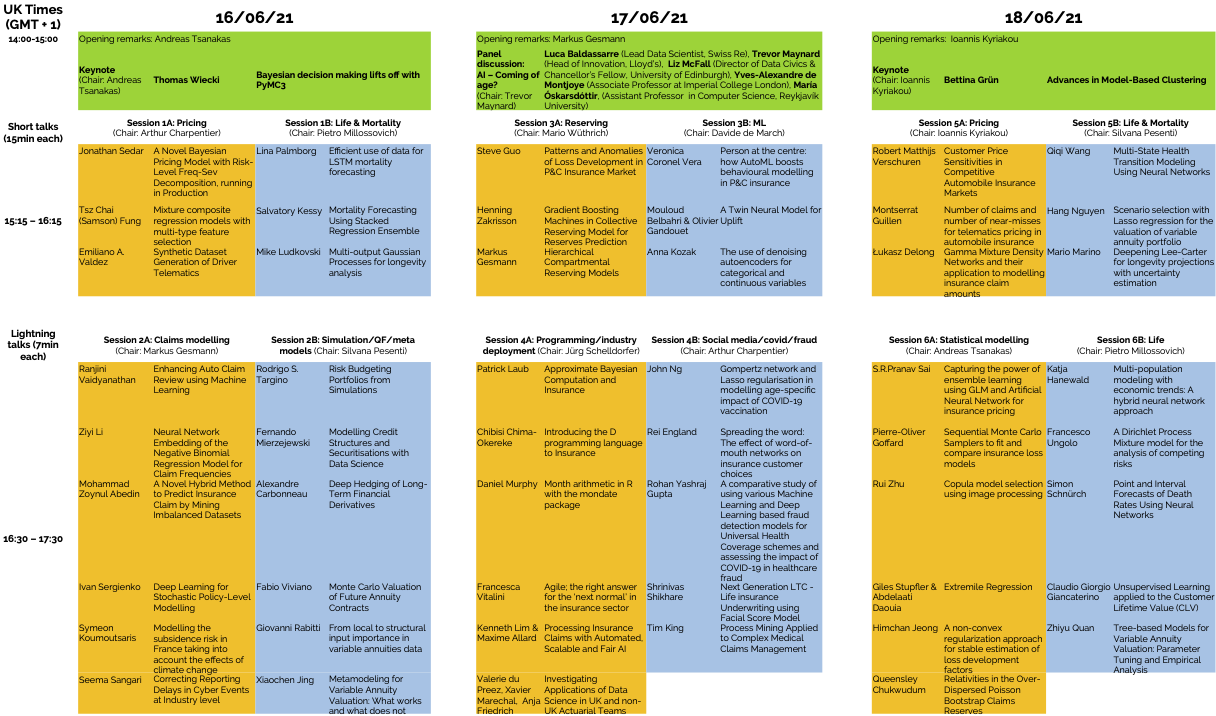

Although all talks took place on Zoom, the interaction of the audience with the speakers was live and active, particularly so during the excellent panel discussion on Thursday. Trevor Maynard (Lloyd’s) discussed with Luca Baldassarre (Swiss Re), Liz McFall (University of Edinburgh), Yves-Alexandre de Montjoye (Imperial College London) and María Óskarsdóttir (Reykjavík University) the challenges of artificial intelligence and whether it is coming of age. There are still many open ethical questions and the exchange of views and opinions, not just across data scientists, is seen as crucial to address them. The European Union had only a few days earlier published its first proposal to regulated AI.

As on Wednesday, the afternoon continued with contributed short and lightning talks from practitioners and academics on topics of pricing, claims modelling, machine learning and, of course, life and death (mortality). In total there were over 50 talks to choose from over the three afternoons. How do you best categorise and allocate them to different sessions? Well, in hindsight we should have asked Bettina Grün (WWU Vienna). Her keynote on Friday was titled “Advances in Model-Based Clustering”. But then again, some randomness is good, particularly at a conference where, by chance, encounters with other attendees can spark new connections and ideas. This can be difficult in a purely online event, but our co-organiser, Silvana Pesenti (University of Toronto), found a great platform that allowed delegates to walk around in a virtual room to meet others. As soon as your avatar would get close to someone else, a little video chat window would open to get the conversation started. Although this does not replace face-to-face meetings, it allowed everyone from around the world to meet on the same terms: no travel required, just curiosity! Still, fingers crossed, we hope to meet in person next year when the conference will take place at Università Cattolica del Sacro Cuore in Milan, Italy, 15 – 17 June 2022.

It remains to say thanks to our sponsors, Swiss Re Institute and Mirai Solutions, without whose generous contributions the conference would not have been possible; the events team at City, University of London for ensuring everyone could login and enjoy a smooth event; the co-organisers in London, Toronto and Montreal; the scientific committee; and, last but not least, all the speakers for their many stimulating talks, answering questions and allowing us to make their presentations available. Thank you all and arrivederci!

Citation

For attribution, please cite this work as:Markus Gesmann (Jun 23, 2021) Notes from the 3rd Insurance Data Science event. Retrieved from https://magesblog.com/post/2021-06-23-notes-from-the-3rd-insurance-data-science-event/

@misc{ 2021-notes-from-the-3rd-insurance-data-science-event,

author = { Markus Gesmann },

title = { Notes from the 3rd Insurance Data Science event },

url = { https://magesblog.com/post/2021-06-23-notes-from-the-3rd-insurance-data-science-event/ },

year = { 2021 }

updated = { Jun 23, 2021 }

}